Business

Digital bank Onyx Private informs customers it is closing their accounts: Report

Miami-based digital bank Onyx Private, once heralded as a beacon for banking innovation targeting high-earning Millennials and Gen Zers, has announced a significant pivot away from its consumer banking operations. The startup, backed by notable investors including Y Combinator, confirmed in a recent communication to its customers that it would be ceasing its banking services, marking the end of its direct-to-consumer model.

In a decisive email dated March 13, Onyx informed its customers of the imminent closure of all associated accounts, signaling a drastic shift in the company’s operational strategy. Victor Santos, co-founder and CEO of Onyx, elucidated that while the move signifies a departure from the business-to-consumer (B2C) model, it does not denote the company shutting down. Instead, Onyx is set to transition towards a business-to-business (B2B) model, specifically targeting community banks, regional banks, and credit unions interested in launching digital applications for the young affluent demographic.

This strategic realignment comes after the startup’s notable $4.1 million venture funding round less than a year ago, which saw contributions from Village Global, Y Combinator, Global Founders Capital, among others. At the time of the funding, Onyx Private had reported a commendable growth trajectory, boasting a 30% month-over-month increase and handling over $4 million in transaction payment value (TPV) per month. Despite these promising figures, the exact number of banking customers has remained undisclosed by Santos, amidst speculations of regulatory challenges influencing the company’s directional change—a notion Santos refutes, attributing the pivot to strategic considerations for scaling in a more capital-efficient manner.

The reorientation towards a platform-as-a-service model represents a calculated effort by Onyx to leverage its technological foundation and cater to financial institutions aiming to captivate the digitally-native consumer base. This move highlights the evolving landscape of digital banking, where adaptability and strategic innovation become crucial to navigating the complexities of regulatory environments and changing consumer expectations.

As Onyx Private embarks on this new chapter, the implications of its pivot will undoubtedly resonate within the fintech sector, potentially setting precedents for similar startups grappling with the challenges of sustaining a consumer-focused banking model. The transition from a promising consumer bank to a B2B service provider reflects the dynamic nature of the fintech industry, where shifts in strategy can redefine a company’s trajectory and its contribution to the digital banking ecosystem.

-

Domains5 years ago

Domains5 years ago8 best domain flipping platforms

-

Business5 years ago

Business5 years ago8 Best Digital Marketing Books to Read in 2020

-

How To's6 years ago

How To's6 years agoHow to register for Amazon Affiliate program

-

How To's6 years ago

How To's6 years agoHow to submit your website’s sitemap to Google Search Console

-

Domains4 years ago

Domains4 years agoNew 18 end user domain name sales have taken place

-

Business5 years ago

Business5 years agoBest Work From Home Business Ideas

-

How To's5 years ago

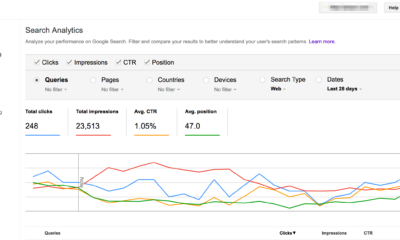

How To's5 years ago3 Best Strategies to Increase Your Profits With Google Ads

-

Domains4 years ago

Domains4 years agoCrypto companies continue their venture to buy domains