Business

Semrush is about to publicly sell shares on New York Stock Exchange

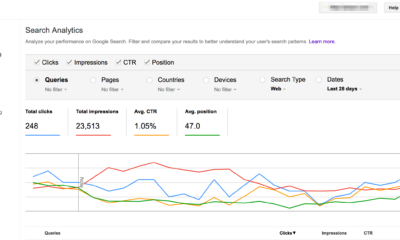

Semrush files are about to go public. It will allow people to buy shares in the company for the very first time. Semrush is announcing its initial public offering for the company stock filed on Monday. It is going to see the SEO software company which is selling the shares on the New York Stock Exchange.

With the registration statement for the proposed IPO, it said that Semrush intends to list the Class A common stock under the SEMR ticker symbol. The number of the shares is going with the price range for the proposed offering. However, this has not yet been determined.

Semrush, an emerging growth company, lets their customers understand the trend along with the actionable insights which are going to lead to the beetle’s online visibility. This premium feature is many favorites for SEOs. However, the software also comes with the solution for PPC, social media marketing, content marketing, and competitive research.

Semrush is offering a total of more than 50 products, tools, and add ons that serve more than 67000 customers. There are the better key details regarding the company, which Semrush reveals that it is filing with the United States Securities and Exchange Commission.

Semrush comes with the details regarding the IPO statement. It includes 12 years of business, 980+ employees in 5 countries, $144 million of annual revenue, gross margin of 76%, 94.9% of customers in the small and medium-sized category, etc.

Investing in Semrush benefits variously. The company says that all net proceeds will re-invest in the further development of Semrush. Also, there are risks. The bigger risk is the changes to the search engine algorithms for the business.

The SEO community says it’s not every day when an SEO software gets listed in the New York Stock Exchange. They have reached out to the SEO community to get their thoughts on the news and what they are expecting from the company in the future.

-

Domains5 years ago

Domains5 years ago8 best domain flipping platforms

-

Business5 years ago

Business5 years ago8 Best Digital Marketing Books to Read in 2020

-

How To's6 years ago

How To's6 years agoHow to register for Amazon Affiliate program

-

How To's6 years ago

How To's6 years agoHow to submit your website’s sitemap to Google Search Console

-

Domains4 years ago

Domains4 years agoNew 18 end user domain name sales have taken place

-

Business5 years ago

Business5 years agoBest Work From Home Business Ideas

-

How To's5 years ago

How To's5 years ago3 Best Strategies to Increase Your Profits With Google Ads

-

Domains4 years ago

Domains4 years agoCrypto companies continue their venture to buy domains