Business

Refer To This Guide To Understand Why Having a Decent Credit Score is Important

Most youngsters in the UK have started making use of loans, credit cards and other financial instruments without properly weighing their pros and cons. Most of them do not pay much attention to building their credit rate, despite it being one of the most important things they should focus on,

Having a good credit score has numerous advantages in the future. Doing it now might seem like a lot of work, most people prefer paying off the minimum amount that appears on their statement each month to be done with it. But here is why you should be mindful of your credit rate right from the start, and how it will benefit you in the long run.

Consider this article a guide about why it’s crucial that you build a good credit score. Read on to find out!

The Benefits of a Good Credit Score

1. Better Interest Rates

Once you have established a good track record by repaying your debt on time or sometimes even before time, it makes lenders more willing to give you money at a lower interest rate. Since you have a good history, lenders like to believe that you will pay off a new loan on time too, resulting in their willingness to offer you one at a lower interest rate.

However, this trust develops over time, and you can enjoy a lower interest only if your credit is in a higher bracket. Your repayment activity is crucial in determining the interest rates banks levy on your loan.

Interest rates can also depend on the economic environment and the current rates in your country. Despite this, having a good rate can always help you in more ways than one.

2. Easier Borrowing in the Future

Let us assume you have owned a credit card for almost 5-10 years now, and after that, you wish to go for an auto loan or a home loan. If your lender sees through your record that you have made almost all your payments on time, including the interest and any extra charges without delay, they might feel confident in lending you money.

In this way, timely repayments on your loans as a part of building your credit will help you borrow more in the future and thus help you lead a comfortable life. You can start building your credit rate from the age of 18, and when you have larger expenses to deal with in the future, that’s when borrowing becomes easier.

3. Increased Negotiating Power

When it comes to home and auto loans, different banks offer different amounts and interest rates. If you have a good credit score, you can negotiate with a bank for a good interest rate. If they do offer you a good rate, you can leverage that and go to another bank for an even lower one.

All of this is possible only if you have a credit score that is generally above 750. If you do not have an exceptional rate, banks and lending institutions will either avoid lending you money, or might do so at a higher interest rate.

With this negotiating power, you can use your good credit to get yourself a plan that works well for your needs. Here, the duration, interest rates, etc., are all up for negotiation, and if you can strike a good deal, it might significantly benefit your financial planning in the long run.

4. Access to Higher Limits

Depending on your age and income, along with your credit history, banks place certain caps on borrowing. This means that you cannot borrow over a certain limit. But with an exceptionally good credit rate, this becomes a non-issue.

With banks displaying a sense of confidence in your ability to repay a loan on time, you’re free to negotiate a higher sum. Having good credit for a long period is also very important in this case. Banks will be more willing to give you a much larger amount to borrow than you if you have a good history. This isn’t necessarily bad as these dealings will take place as per your bank’s regulations. However, things will be easier for you as It will just be much easier for you to borrow the amount you need to meet your demands.

5. Safety During Credit Checks

Credit checks are extremely common, especially in cases of employment. If an employer wants to judge your efficiency and reliability, they might ask to look at your credit score and patterns if needed, among other such details.

While this is not the most important criteria to judge someone, it must work in your favour and give you an edge over your competitors. If you have a better credit rate than the rest, the employer might assume that your financial efficacy will also reflect in your work. It also shows that you are organised and know how to manage your finances well without using payday loans, or delaying any payments.

On the flip side, if you have a poor credit score, an employer might hesitate in bringing you on board since they might think that your callous financial attitutd will reflect in your work. This might seem insignificant now, but if the competition comes down to yo and another candidate without all other criteria put aside, you must have a credit score that helps you, rather than work against you.

Conclusion

All in all, having good credit is important not only from the perspective of the points mentioned above but also for your own peace of mind. Having bad credit has financial repercussions and can lead to several losses in the future due to increasing interest rates that can get you caught in a debt trap.

There are many reasons why people find out about how to improve credit score. One of the most common ways is to keep borrowing amounts that you can be sure of repaying within their deadlines, ensuring that each transaction positively impacts your credit score. This will show that you are financially well-versed and reliable and know your capabilities in terms of interest and repayment amounts.

-

Domains6 years ago

Domains6 years ago8 best domain flipping platforms

-

Business6 years ago

Business6 years ago8 Best Digital Marketing Books to Read in 2020

-

How To's6 years ago

How To's6 years agoHow to register for Amazon Affiliate program

-

How To's6 years ago

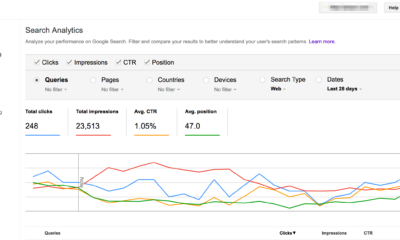

How To's6 years agoHow to submit your website’s sitemap to Google Search Console

-

Domains5 years ago

Domains5 years agoNew 18 end user domain name sales have taken place

-

Business6 years ago

Business6 years agoBest Work From Home Business Ideas

-

How To's6 years ago

How To's6 years ago3 Best Strategies to Increase Your Profits With Google Ads

-

Domains5 years ago

Domains5 years agoCrypto companies continue their venture to buy domains