News

Balancing Fame and Finances: Emma Kanngiesser on Managing Money as a Model and Student

Emma Kanngiesser is a successful fashion model and dedicated student, navigating the demanding worlds of fashion and academia with grace and determination. With a flourishing modeling career and a keen interest in financial management, Emma has mastered the art of balancing her busy schedule while effectively managing her finances. Supported by a team of advisors and armed with the knowledge from her studies, she ensures a stable and prosperous future. In this interview, Emma shares her insights and strategies for maintaining financial health and offers valuable advice for young professionals aiming to achieve financial stability while pursuing their careers and education.

https://www.instagram.com/kngemma/?hl=en

As a successful fashion model and a student, how do you balance managing your finances with your busy schedule?

Balancing my finances with a busy schedule as a successful fashion model and a student can be quite challenging. Fortunately, I have a great team of tax and financial advisors who help me manage my finances efficiently. They take care of the technical aspects, ensuring I make the most of my earnings and comply with all regulations. Additionally, I implement what I learn in my studies to make informed decisions and stay on top of my financial goals. This combination of professional support and personal knowledge allows me to maintain a healthy balance between my career and education.

What are some key financial principles or habits you’ve adopted to ensure you manage your income effectively?

To manage my income effectively, I keep a detailed budget and prioritize saving a portion of my income each month. With the help of my financial advisors, I invest in diversified portfolios. I apply the financial principles I learn in my studies to make informed decisions. By focusing on essential expenses and regularly reviewing my finances, I maintain stability and work towards long-term financial security.

Can you share your approach to budgeting and how you allocate your earnings between expenses, savings, and investments?

Sure! When it comes to budgeting, I like to keep things straightforward. I track my income and expenses using an app, which helps me see where my money is going. I usually allocate a set percentage of my earnings to different categories.

For expenses, I cover all my essentials first. After that, I make sure to save a good chunk of my income. I’ve got an emergency fund that I add to regularly, and I also save for future goals, like travel or a big purchase.

Investing is something I’ve started doing with the help of my financial advisors and my studies. They guide me on where to put my money to help it grow over time. It’s a mix of stocks, bonds, and other investments, which I review regularly to make sure everything’s on track.

Overall, the key is balancing my spending, saving, and investing in a way that supports my current needs and future goals.

What strategies do you use to track your spending and savings, and how have they helped you stay on top of your finances?

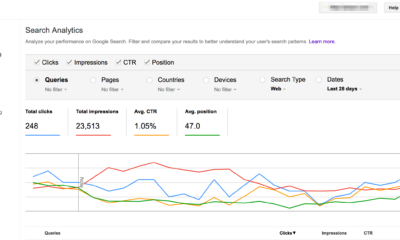

I use a few strategies to track my spending and savings that have really helped me stay on top of my finances. First, I rely on a budgeting app that automatically categorizes my expenses and shows me where my money is going. This makes it super easy to see if I’m overspending in any area and adjust accordingly.

I also set up automatic transfers to my savings account right after I get paid. This way, I’m consistently saving without even thinking about it. For investments, I check in to review my portfolio and make sure it aligns with my goals.

These strategies keep me organized and give me a clear picture of my financial health. It’s all about making things as simple and automated as possible so I can focus on my busy schedule without worrying about my finances.

What advice do you have for young people under the age of 25 who are just starting to earn their own money and want to build good saving habits?

My advice for young people under 25 who are starting to earn their own money is to start small and be consistent. Set up a budget to track your spending and prioritize saving a bit from each paycheck. Automate your savings if you can, so you don’t have to think about it. Focus on building an emergency fund first, then look into investing. Lastly, educate yourself about personal finance to make informed decisions. Small, steady steps can lead to great habits and long-term financial security.

Can you share any mistakes or lessons you’ve learned about money management that you think others could benefit from?

A valuable lesson is the power of saving and investing early. The sooner you start, the more your money can grow over time thanks to compound interest. Also, getting professional advice has been incredibly beneficial. Financial advisors have provided insights and strategies I wouldn’t have thought of on my own. These lessons have reinforced the importance of being proactive and informed about my finances.

What financial advice would you give to aspiring models or university students who are looking to achieve financial stability while pursuing their careers and education?

My advice for aspiring models and university students is to create a budget and stick to it. Prioritize saving a portion of your earnings, even if it’s small. Automate your savings to make it easier. Invest in your education and seek professional financial advice when needed. Stay informed about personal finance to make smart decisions. Balancing your career and education while managing your finances will set you up for long-term stability.

-

Domains6 years ago

Domains6 years ago8 best domain flipping platforms

-

Business6 years ago

Business6 years ago8 Best Digital Marketing Books to Read in 2020

-

How To's6 years ago

How To's6 years agoHow to register for Amazon Affiliate program

-

How To's6 years ago

How To's6 years agoHow to submit your website’s sitemap to Google Search Console

-

Domains5 years ago

Domains5 years agoNew 18 end user domain name sales have taken place

-

Business6 years ago

Business6 years agoBest Work From Home Business Ideas

-

How To's6 years ago

How To's6 years ago3 Best Strategies to Increase Your Profits With Google Ads

-

Domains5 years ago

Domains5 years agoCrypto companies continue their venture to buy domains